Retailers and wholesalers received a resounding wake-up call when the global pandemic hit in 2020. Their “business as usual” attitude was quickly replaced with “do-whatever-it-takes” tactics to stay relevant and accessible to customers. As physical distributor storefronts closed, buyers were forced to turn to digital channels for their buying needs. Those without a digital presence have struggled to manage customer expectations, while those with an eCommerce platform continue to maintain and, in some cases, thrive during the outbreak. Consider marketplace disruptors like Amazon Business and eBay, who grew 40% and 24% in revenue, respectively, in the second quarter this year.

As Jonathan Bein and Ian Heller of Distribution Strategy Group explain in their latest webinar and report, COVID has catapulted the importance of digital selling tools in the wholesale distribution marketplace. But the virus isn’t the only disruptor for distributors; emerging technologies and marketplace channels also affect their relevance and future success.

In partnership with NAW, Heller and Bein’s research sheds light on two digital technology trends that are coming down the pipeline and explains the opportunities and risks that new marketplaces pose to distributors. As a sponsor of this technology disruption series, Unilog has summarized their key messages.

For a full breakdown of their latest insight, download their research report and watch the webinar.

Digital technologies already gaining traction in the retail marketplace

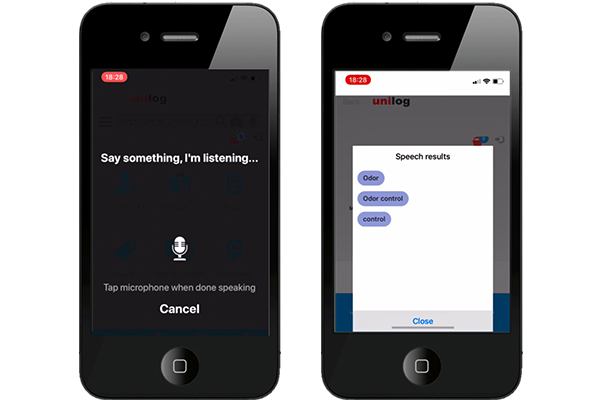

In the second installment of their seven-part series, Heller and Bein detailed a handful of artificial intelligence (AI) technologies making their way to the wholesale distribution arena. While they admit some may not gain a lot of traction in the B2B space, others like voice ordering and item recognition (image search) will be in high demand by buyers in the near future.

As Bein maintains in their latest report, the retail marketplace is a good predictor of what’s going to flow into the B2B world. Based on the efficacy these tools already provide consumers, Bein predicts voice ordering and item recognition will be relevant in the wholesale distribution marketplace in the next few years.

However, both B2B industry experts point out that neither of these tools will work without enriched product data in place. “If you want to match items to an image, you not only need AI that can interpolate the pixels into product attributes, you have to have product attributes and multiple images for each product,” contends Heller. “The bar is being raised, once again, for the quality of product data,” adds Bein.

Together, great product content and Unilog’s mobile app version of your website allow buyers to search your catalog for items wherever they are

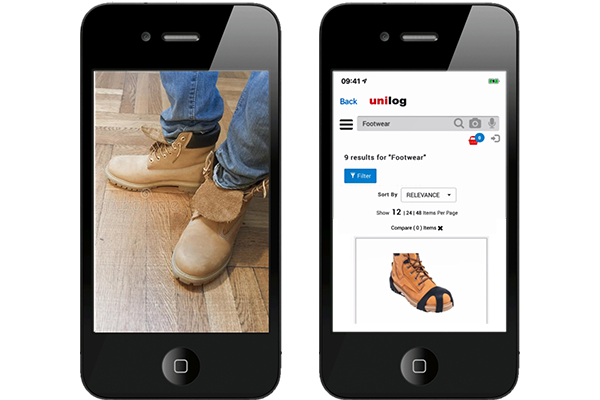

Heller contends there will come a time when buyers will use item recognition and voice ordering together to find and order products. When this happens, businesses must have both technology and rich product content in place. “It’s going to be a problem in the not-so-distant future when they (customers) demand you match items with an image from their smartphone,” says Heller.

B2B buyers want the ability to take a picture with their phone and use it to search your catalog for matched items; with Unilog’s mobile app, then can

Marketplaces and manufacturers enter the competitive arena

As technology continues to widen the competitive gap, new players are entering the market to create further shake-ups. Marketplaces are popping up everywhere touting a larger assortment of products, aggressive prices, and greater availability. Heller and Bein report retailers such as Home Depot have purchased distribution companies in order to pursue more business customers. Larger distributors like Grainger have also built or plan to build proprietary marketplaces, and even buying groups are entering the fray.

On top of that, manufacturers are starting to sell direct to end customers. A 2019 survey by Worldwide Business Research and B2B Online reveals 50% of US manufacturers plan to launch their own marketplaces and 43% expect to sell on other marketplaces. Heller claims these numbers reflect their frustration about many distributors’ lack of serving customer’s digital needs.

These insights are not meant to be an attack on distributors but, rather, a wake-up call. Heller and Bein say three steps must be taken now if they want to remain competitive:

- Invest in world-class digital capabilities: Build a strong digital branch that features a responsive design, dedicated product information management (PIM) tool, enriched product catalog, sophisticated site search, self-service features, and a mobile app.

- Build extensive value-added services: Provide 24/7 support, offer events like certifications and workshops, and develop offerings like rental programs

- Make your business essential to customers: Use digital tools to configure solutions for their complex needs and create more consultative roles to build deeper customer relationships.

These three components should be the basis of your marketplace strategy so you can compete in the near and distant future. Technology and customer needs will never stop evolving, so why should you? For more research and recommendations, access Distribution Strategy Group’s latest research report and webinar.

Unilog would love the opportunity to help you on your digital journey. Contact us to learn more about our enriched content services and all-in-one eCommerce platform that offers the essential tools and features to deliver the best B2B digital experience.